santa clara property tax appeal

Browse HouseCashins directory of Santa Clara top tax advisors and. Agricultural Preserve Williamson.

COUNTY ASSESSMENT APPEALS FILING PERIODS FOR 2021.

. 555 County Center - 1st Floor. They benefited from Proposition 13 which lets a longtime homeowner transfer their property tax to a new property even though. Hi everyone Last fall I spent about 6 hours preparing a written appeal of Santa Clara County CA property tax increases.

Choose from 3 attorneys by reading reviews and considering peer ratings. A secured property tax bill is generally a tax bill for real property which could include your home vacant land commercial property and the like. Get peer reviews and client ratings.

The Clerk of the Board accepts Applications from taxpayers seeking a reduction in property tax assessments and reviews Applications for compliance with State and local rules and regulations. Looking for the best property tax reduction consultant in Santa Clara California to help you with property tax appeal. Karthik saved 38595 on his property taxes.

Redwood City CA 94063. Hearings are scheduled before Assessment Appeals hearing officers or the Appeals Board. They may have appealed their property tax before.

Assessment Appeal Application form. My analysis showed that Im paying 5 higher than comparable. CA State Board of Equalization Publication 29.

See reviews photos directions phone numbers and more for County Property Tax Appeal locations in. The clerks of county assessment appeals boards and county boards of equalization have certified the assessment appeals filing. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in.

The Clerks office provides meeting support by preparing and publishing. The process was simple and uncomplicated. Please note the review process may take 45-90.

Disaster or Calamity Relief Section 170 Print Mail Form. Sign and date the form and submit online or by mail. January 2022 At the end of December 2021 Santa Clara County Assessors office officials commented on the state of property valuation in light of the impact COVID-19 has had on real.

Page 2 for information on who can file. The term secured simply. I had a fantastic experience getting my property tax deal processed through TaxProper.

Appeal Response Form WithdrawalContinuanceWaiver Request - DocuSign Online Submission. Find a local Santa Clara California Property Tax Appeals attorney near you. To appeal the value of your property you must file an Assessment Appeal Application with your local appeals board see.

Parcel Boundary Change Request. See reviews photos directions phone numbers and more for County Property Tax Appeal Spe. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated.

Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax. Find the right Santa Clara Property Tax Appeals lawyer from 2 local law firms. Attach documentation that supports the basis of your request to cancel your tax penalty.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Step By Step Guide How To Calculate California Property Taxes

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Commercial Property Tax Shannon Snyder Cpas

Santa Clara Shannon Snyder Cpas

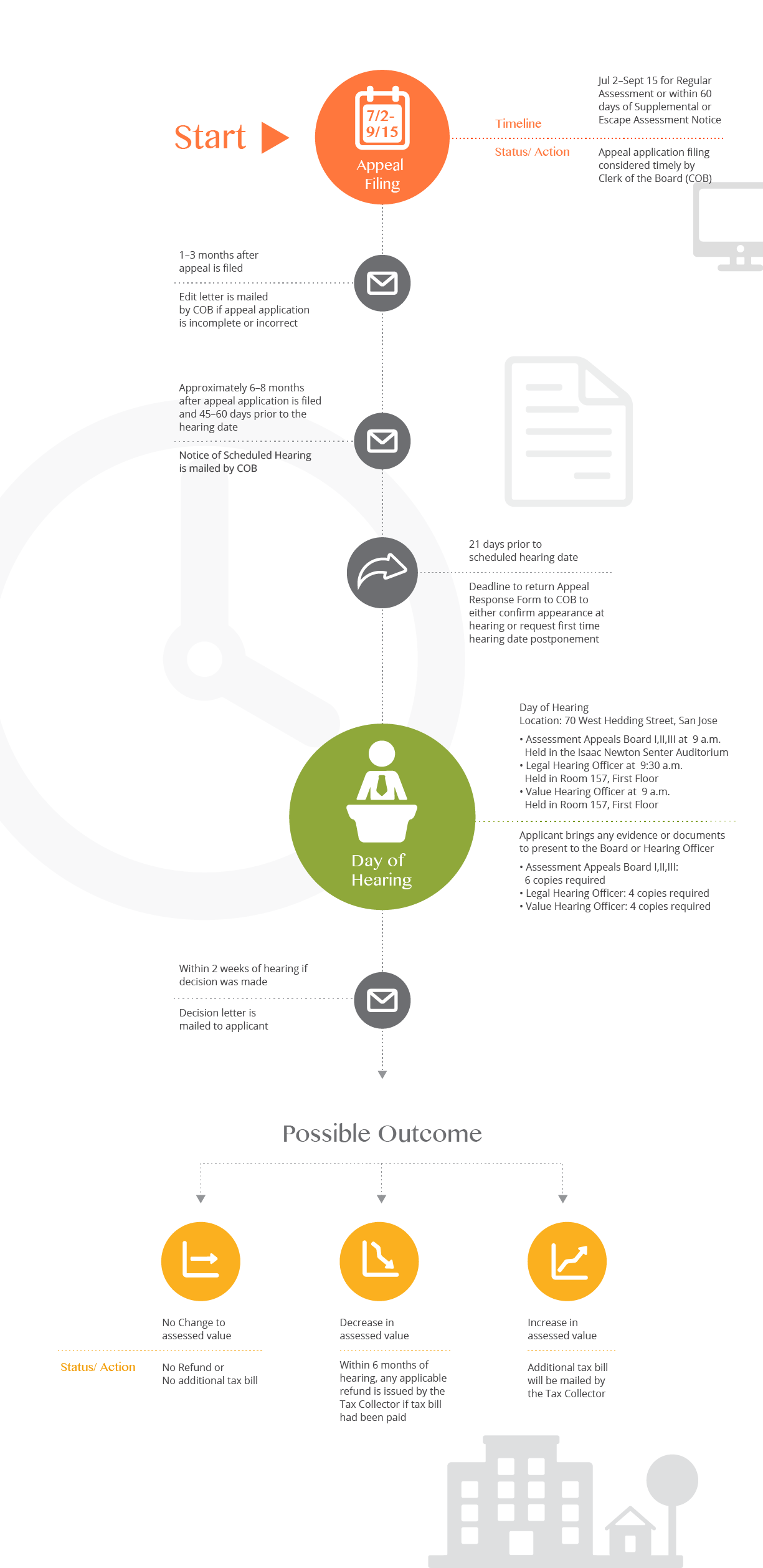

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

San Jose Tax Appeal Attorney San Francisco Tax Lawyer Offer In Compromise

Tax Appeal Shannon Snyder Cpas

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

San Jose Tax Appeal Attorney San Francisco Tax Lawyer Offer In Compromise

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities